Homebuyers are inundated with good news. Earlier this month, the budget proposed an additional deduction of ₹1.5 lakh on interest paid on loans for affordable housing priced up to ₹45 lakh. Last week, the State Bank of India reduced its marginal cost of lending rate (MCLR) by 5 basis points across all tenures. By themselves, both measures are likely to have a limited impact. The additional deduction may not get fully utilized and the rate cut by SBI is marginal at best. However, if these benefits are combined with an earlier change in GST rules, the pressure on the buyer’s pocket could ease significantly.

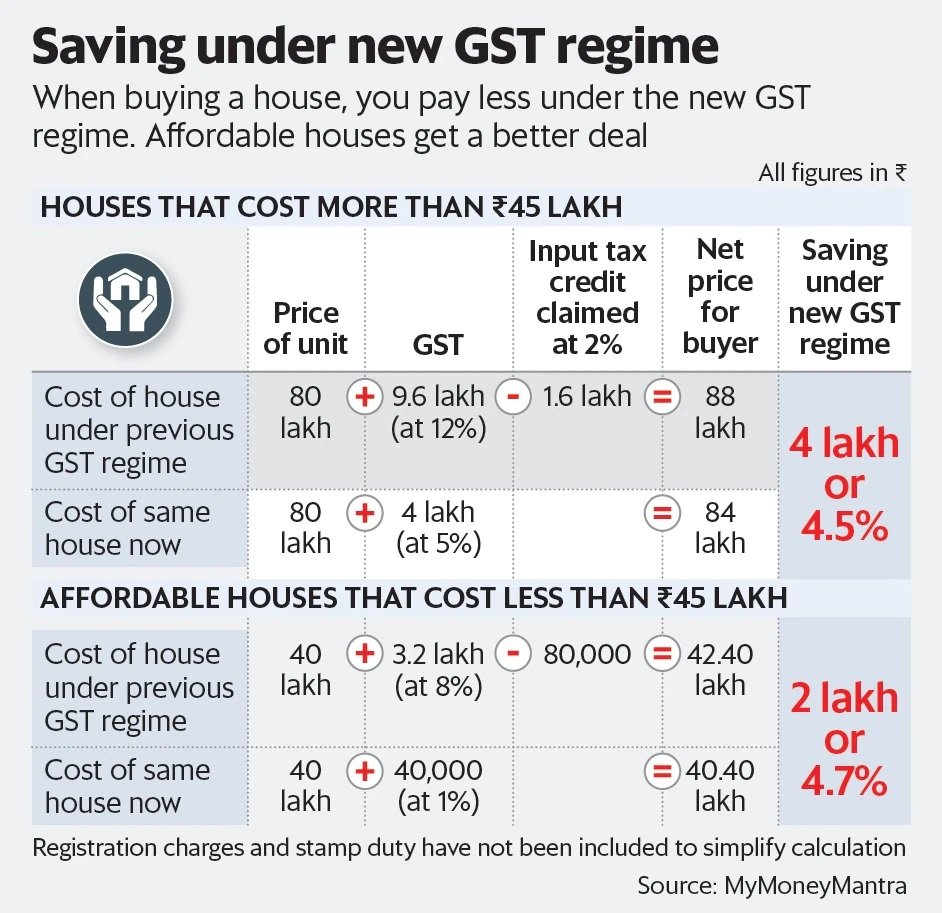

In March, the GST Council reduced the GST rate for residential under-construction property from 12% to 5% and for affordable housing from 8% to 1%. The real estate sector, which was floundering under the triple impact of the Real Estate Regulation Act, demonetisation in 2016 and introduction of GST in 2017, finally had something to cheer about.

However, the reduction in GST rates will not reduce home prices for buyers to the same extent. Under the new rules, developers will not be able to claim input tax credit (ITC). The new tax rules also say that 80% of inputs and input services must be purchased from registered persons. Any shortfall in purchases according to these norms, will attract a tax levy. For instance, tax on cement purchased from an unregistered person shall attract a 28% duty. Under the previous regime, the builders could claim ITC for the tax they paid when procuring various products and building materials, including steel, cement, paints and electrical items. This used to be in the range of 2-3% of the base price. Also, keep in mind that the introduction of GST has not subsumed the stamp duty and registration fees that are still a state subject and vary depending upon the location of the property.

If they can’t claim ITC, builders are likely to hike the base price of the unit to account for the unclaimed amount. This, in turn, will eat into the overall gain of the buyer from the GST rate cut. The overall gain is reduced from 7% to merely 4.5% due to the elimination of ITC.

But even after taking into account the loss of ITC, the lowering of GST rate will translate into significant savings for homebuyers, especially those choosing the affordable segment (see graph).

Under GST rules, sale of a ready-to-move-in residential or commercial property is not considered a supply of a good or service. As a result, no GST is payable in such cases. The tax only applies to under-construction property. Till now, ready property was more in demand because there was no GST. But the rate cut has reduced the price gap between under-construction and completed projects in the affordable segment. This is likely to revive demand for under-construction affordable housing projects, especially in newer markets and emerging cities.

The redefinition of affordable housing and the GST rate cut could breathe new life into the real estate sector. It will also simplify tax rules for the real estate sector and improve compliance.

Source : Live mint