The latest GST rates for housing projects under construction will increase the cost of most housing units, barring those in the super-premium category, turning PM Modi’s ‘Housing for all by 2022’ mission on its head!

The new proposed GST rates for housing projects under construction could lead to increase in the cost of most of the housing units in the affordable and semi-premium segments.

Only the super-premium housing units in the price range upwards of Rs 15,000 per sq ft would be benefited under the new proposed GST rates.

The GST council in its meeting on Sunday is likely to adopt the new GST rates suggested by a group of ministers. Under the new scheme, a flat GST at the rate of 5% without allowance of input tax credit would be levied on premium housing and at the rate of 3% on affordable housing.

Under the existing system, GST at the rate of 12% is levied on premium housing project under construction, but with allowance of input tax credit, and the rate is 8% on affordable projects.

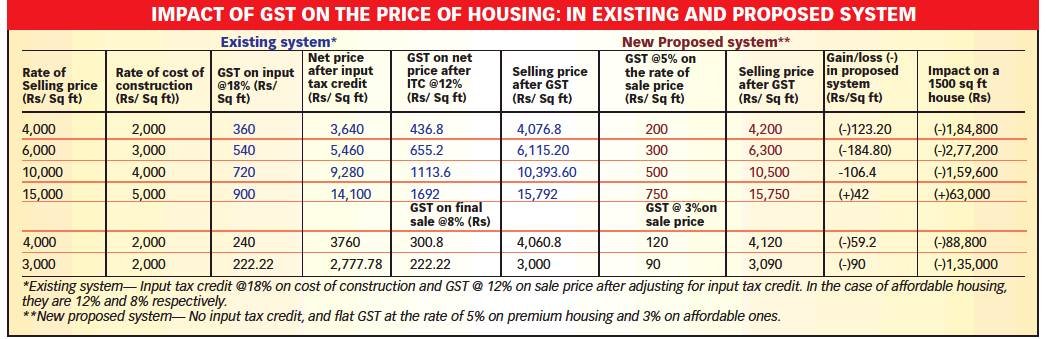

But, because of the input tax credit, the net rates go down substantially in the range of nil to 5% on most of the housing projects. The input tax credit is given in lieu of the GST paid on inputs like cement, steel, bathroom fittings, and other services availed to complete the construction. On average, input taxes are equivalent to 18% of the cost of construction, which varies between Rs 2,000 per sq ft for average-quality to around Rs 5,000 per sq ft for super-quality of construction.

Take for example, a project with a selling price of Rs 10,000 per sq ft: As shown in the chart, if the cost of the construction of such project is Rs 4,000 per sq ft, the input tax would be around Rs 720 per sq ft, which is available for the credit to a buyer. Therefore, the developer first reduces the price by the available input credit, which is Rs 720 per sq ft in this case. Now, the selling price would become Rs 9,280 per sq ft.

The buyer will have to pay GST at the rate of 12% on this price. Therefore, as shown in the chart, GST would be levied at Rs 1,113.60 per sq ft taking the final cost for the buyer at Rs 10,393.60 per sq ft. Therefore, the net tax paid after input tax credit is Rs 393.60, which is 3.93%.

Under the new regime, tax will be levied at a flat rate of 5%. Therefore, the final sale price would increase by 5%, which would be Rs 500 per sq ft, taking the final rate to Rs 10,500 per sq ft.

Therefore, in the new case, the buyer must pay Rs 106.40 per sq ft. Therefore, the price will increase by Rs 1.59 lakh on a flat of 1,500 sq ft.

Similarly, as shown in the chart, the price of affordable housing will also increase under the new system.

Pankaj Goel, director of Express Builders and a senior member of Credai, said that as the tax outgo will increase in the new system, the developers’ ability to bring down the price would be adversely affected.

The prices are already rock bottom, but as the tax liability will increase, prices will go up, affecting the sector adversely. If developers absorb the tax burden, their financial condition would worsen further.

Some government officials blame developers for not passing the input tax credit, though.

Rohit Raj Modi, director of Ashiana Homes, said market is so competitive that developers are forced to pass on the input tax credit to buyers. He says that developers pass on the benefit to avoid action by anti-profiteering wing of the department in the projects under construction.

NEW GST RATES JOLT SECTOR!

GST from buyers is not a source of revenue, which is clear from the fact that after a project receives completion certificate no GST is levied. Thus, the government should lower the GST rate from 5% to 3% for the premium and affordable segment, respectively, but with an allowance of input tax credit, a tax consultant said.