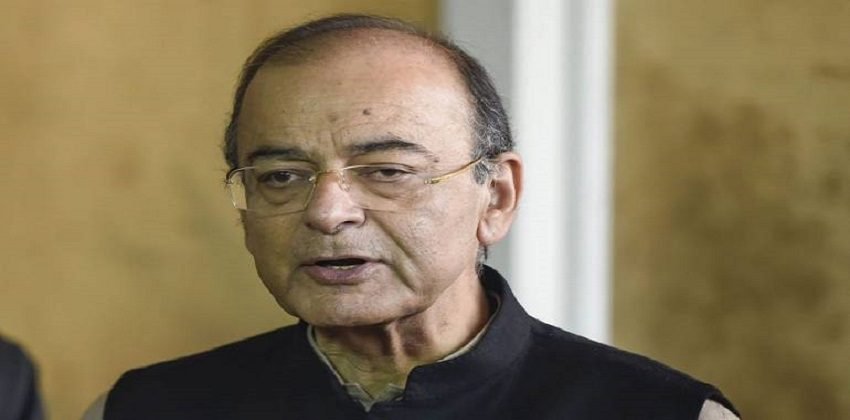

Finance Minister Arun Jaitley said that discussions in today’s GST Council meet were inconclusive and the Council will try to take a decision on real estate on February 24.

The Goods and Services Tax (GST) Council meeting on February 20 remained inconclusive after some state finance ministers sought a physical meeting as they felt an issue as crucial as a special scheme for real estate sector should not be discussed through a video conference. The meeting will now take place in Delhi on February 24.

“I have always followed the approach of moving as per consensus and some of the states wanted meeting where members are physically present, keeping the idea of consensus in mind, I adjourn the meeting to Sunday (February 24),” Finance Minister Arun Jaitley said after the meeting.

Moneycontrol had on Tuesday reported that as many as six states, including Delhi, Kerala and Punjab have requested Finance Minister and the head of the GST Council Arun Jaitley to postpone the 33rd Council meeting via video conference and call for a physical meeting.

The meeting was also expected to address another issue– a single rate of tax on lottery — that some states believe should be taken up in the presence of each and every member of the Council.

Currently, the GST Council has 33 members, including Jaitley and state finance ministers or any other representative from every state.

The Council met today to consider the reports of two ministerial panels pertaining to real estate and lottery.

One of the panels, headed by Gujarat Deputy Chief Minister Nitin Patel has recommended 5 percent GST on under-construction properties and 3 percent tax in case of affordable housing category. However, in both cases, input tax credit (ITC) cannot be claimed.

Currently, GST is levied at an effective rate of 12 percent (standard rate of 18 percent less a deduction of six percent as land value) on premium housing and effective rate of eight percent (concessional rate of 12 percent less a deduction of four percent as land value) on affordable housing on payments made for under-construction property or ready-to-move-in flats where completion certificate has not been issued at the time of sale.

The panel headed by Maharashtra Finance Minister Sudhir Mungantiwar has uniformity of taxation on lottery under GST and has recommended 18 or 28 percent tax rate. The final called will be taken by the Council.

Under GST, state-organised lottery falls under the 12 percent tax slab while state-authorised lottery attracts 28 percent tax.

Source : MoneyControl